Image source: Unilever plc

Falling interest rates reduce the passive income that people earn from their savings accounts. Many accounts that once held a steady rate above 5% are now falling as low as 3%.

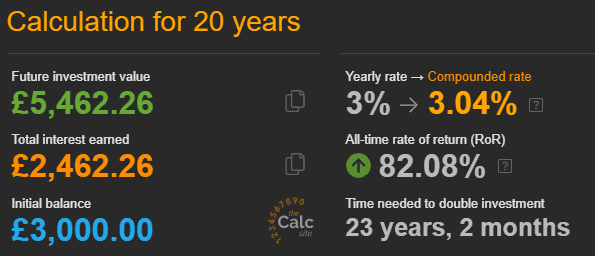

These days, holding a sum of around £3,000 in savings won’t return much. For instance, in 20 years, a 3% rate would only grow to around £5,462.

When factoring in inflation at the Bank of England’s 2% target, it equates to very little. While many appreciate the safety and security that savings accounts offer, some might consider looking for faster ways to grow that money.

Is there a (relatively) safe way to aim for a more meaningful return?

Risk vs return

Many stocks on the FTSE 100 have historically delivered annualised returns upwards of 10% a year. In fact, some have delivered even more (but with higher returns come higher risk).

What’s more, many of these stocks pay annual dividends upwards of 5%. That means investors have a chance of beating their savings account even if the stock price doesn’t grow at all.

But the risk of losses is concerning. Money stagnating in a savings account isn’t ideal but losing it all is worse. That is the core reason why many people never invest — the market is confusing and even a small risk seems too high.

Consider defensive stocks

While no investment is without risk, some are considered to be low risk. These are typically companies in high-demand industries. Think energy, retail and pharmaceuticals.

They are usually industry leaders, with limited competition and a history of reliable performance. Note, ‘reliable’. Not exceptional, not mind-blowing. Just slow, steady and stable.

Such stocks are often referred to as defensive stocks, as their performance is resistant to wider market fluctuations.

Consider the multinational consumer goods company Unilever (LSE: ULVR). Between 2014 and 2024, it achieved annualised growth of 5.7% a year. And that’s before dividends, which currently yield 3%.

Sure, it doesn’t hold a candle to parabolic growth stocks like Nvidia. But where will it be in 10 years? Who knows.

Selling essential brands like Dove, Ben & Jerry’s, Hellmann’s and Vaseline, Unilever’s well-positioned to continue growing indefinitely.

But that doesn’t guarantee growth. It could still lose market share to competitors or suffer losses due to supply chain disruptions. Anything from environmental disasters to currency fluctuations can hurt profits.

And if it passes these costs on to the consumer, it risks losing customers to low-priced alternatives.

Still, with products used by 2.5bn people daily in 190 countries around the world, its market position is very well-established.

Path to passive income

£3,000 would buy around 65 Unilever shares. Assuming current averages held, in 20 years they could grow to be worth almost £16,000 (with dividends reinvested). I don’t know any savings account that could achieve that.

National Grid’s another defensive stock offering similar reliability and growth. As the main gas and electricity provider in the UK, it enjoys consistent demand. Growth is slow but it has a 5.7% dividend yield and a long track record of consistent payments.

It could achieve similar results to Unilever over 20 years.

I plan to drip-feed my savings into these shares and similar defensive stocks until retirement. By compounding the gains, I hope to achieve a reliable passive income stream.