Image source: Getty Images

It’s a simple fact that Brits aren’t setting aside enough money to help them fund their retirement. The rising cost of living means the amount we have to save or invest — such as by buying UK growth and dividend shares — is on the decline.

Scottish Widows’ latest annual ‘Retirement Report’ underlines the scale of the problem. After interviewing 5,072 UK adults, the pensions giant said that “38% of people are now on track for living standards in retirement below the minimum level“.

That’s 3% higher than 2023’s survey. To put that in perspective, it means an extra 1.2m people are on course to enjoy a sub-minimum standard of living when they retire.

Here’s my plan

So what would life like look like under this life standard category? Scottish Widows’ has used the Pensions and Lifetime Savings Association’s (PLSA) definition of the minimum living standard, which for a single person allows for:

- £50 a week for groceries, and £25 a month for eating out

- No car, and £10 a week for taxis and £100 a year for trains

- A week-long UK holiday each year

- A basic TV and broadband package

- £630 a year to spend on clothing and footwear

To me, this is a pretty chilling prospect. I don’t plan to spend most of my life working only to then live on the breadline when I eventually retire. I’m sure you feel the same!

So I invest as much as I can every month to try and build a healthy nest egg for retirement, even during this cost-of-living crisis. The earlier we all begin our journey, the better.

But I believe that high-yield dividend shares — like the one described below — could help even those who begin investing later in life to enjoy a comfortable retirement.

7.2% dividend yield

Aviva (LSE:AV.) has one of the largest forward dividend yields on the FTSE 100 today. At 7.2%, it is double the index average of 3.6%.

Financial services businesses can be vulnerable during economic downturns when consumer spending falls. But thanks to its formidable cash reserves, Aviva looks in good shape to continue paying large dividends for the foreseeable future.

Its Solvency II capital ratio was an impressive 206% as of March. This even allowed the business to buy back a whopping £300m of its shares earlier this year.

I’m confident Aviva will have the means to steadily grow dividends over time, too. Demand for its pensions, savings, and protection products should rise considerably thanks to favourable demographic changes.

A £30k+ passive income

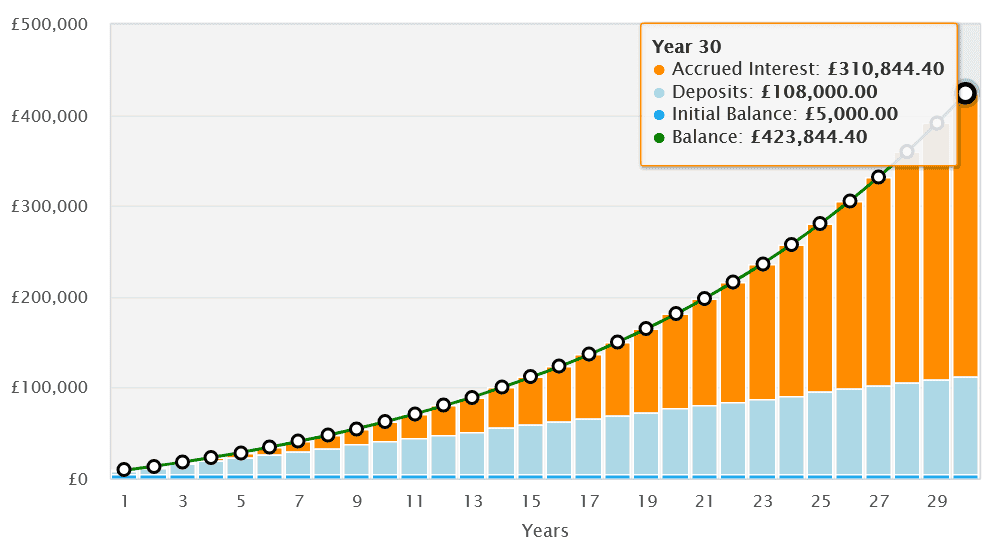

If I had £5,000 to invest in Aviva shares, I could expect to make an annual passive income of £360 this year. That’s based on the company’s 7.2% dividend yield for 2024.

If dividends remain the same along with the share price, my £5k lump sum would turn into £43,077 after 30 years with dividends reinvested. If I supplemented this initial investment with an extra £300 a month, I could turn this into £423,844 by 2049.

At this point I’d be earning an annual passive income of £30,517. Combined with the State Pension, this could be more than enough to allow me to retire in comfort.