This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

MicroStrategy has bought more bitcoin, and an analyst team has upped its Coinbase stock price target. But first a look at bitcoin miners, which are increasingly raising capital via convertible note issuances.

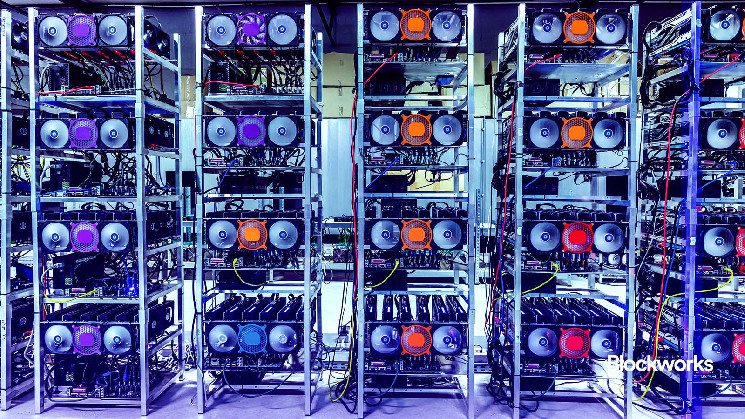

Bitdeer last month unveiled a $360 million convertible senior notes offering. Then last week, Marathon Digital, Core Scientific and Iris Energy initiated convertible notes offerings — amounting to $850 million, $550 million and $400 million, respectively.

Seven publicly traded BTC miners and data center companies have raised a combined $5.2 billion via convertible notes since June, according to data compiled by TheMinerMag. About 70% of that came in the last four weeks.

That MinerMag stat doesn’t include the most recent issuance: Riot Platforms on Monday proposed a $500 million convertible notes offering.

These moves reflect mining firms capitalizing on growing bullish sentiment around bitcoin among institutional investors, BlocksBridge Consulting founder Nishant Sharma told me.

“This trend is likely to continue, as we’re in the early stages of a new crypto bull run,” he added. Bitcoin’s price was about $98,000 at 2 pm ET Monday — down 3% from 24 hours ago.

Bitdeer noted the proceeds of its offering would go toward data center expansion, as well as ASIC-based mining rig development and manufacturing.

The firm’s stock has surged 86% over the past month and more than 27% during last Friday’s trading session alone, Benchmark’s Mark Palmer wrote in a Monday research note. Last week’s rally came after the company boosted its SEALMINER A2 mining rig hashrate projection in 2025 from 18 exahash per second (EH/s) to 35 EH/s.

Palmer raised his Bitdeer stock price target from $16 to $29 — noting “the company’s multifaceted business model provides investors with multiple ways to realize upside.”

Marathon and Riot specifically mentioned having their eye on using the capital to buy more BTC. MARA and RIOT share prices are down 3% and down 23%, respectively, over the past month.

Sharma said it wouldn’t surprise him to see Marathon aggressively follow the “compelling precedent” set by MicroStrategy, noting MARA and competitor CleanSpark, for example, are well-positioned to take “decisive action” on both mining and “hodling.”

Marathon holds 34,959 BTC, while CleanSpark has 9,297 bitcoins. Hut 8 Mining has 9,122 BTC and said it would use some proceeds from its latest at-the-market (ATM) and stock repurchase programs to purchase more bitcoin “as a strategic reserve asset.”

As teased at the top, MicroStrategy bought another 21,550 bitcoins (for about $2.1 billion in cash) between Dec. 2 and 8, bringing its total pile to 423,650 BTC.

MSTR stock was down more than 4% at 2 pm ET — a bit more than Monday’s BTC price decline.

Coinbase’s share price had dipped 7% Monday by that time, to about $318. Still, Needham analysts John Todaro and Brian Vieten on Monday raised their COIN price target from $375 to $420, noting the crypto exchange is on track (in December) to have its best volumes month since May 2021.