Image source: Getty Images

There are lots of ways that people try to build generational wealth. Some buy property that they pass down the line when they die. Others buy fine art, gold coins or other high-worth collectibles. But in my opinion, the best way to make long-term wealth is to buy FTSE 100 and FTSE 250 shares.

A quick glance at the long-term returns of these two London share indices shows why. The Footsie has delivered an 8% average annual return since it began in 1984. The FTSE 250, meanwhile, has produced an even better 11% average return since it started up in the early 1990s.

Remember that past performance is no guarantee of future profits. However, an average 9.5% yearly return for the two combined illustrates the potential returns that can be achieved by investing in UK shares.

With this in mind, here is a FTSE 100 share I think help could generate stunning generational returns.

Banking giant

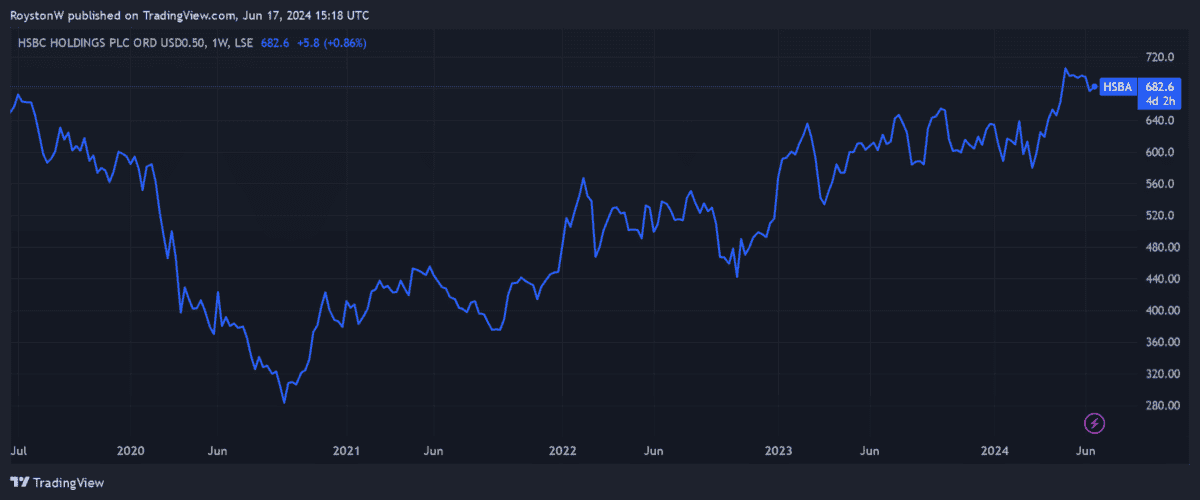

HSBC Holdings (LSE:HSBA) is one of the world’s biggest banking groups. It’s also the largest bank on the London Stock Exchange by market cap (its shares are worth a whopping £126bn).

The Footsie bank is looking increasingly to Asia to drive long-term profits. And who can blame it? A combination of explosive population growth and increasing personal incomes mean banking product penetration demand looks set to soar from current low levels.

Analysts at Statista predict banks’ net interest income will expand at a compound annual growth rate of 5.8% between now and 2029. This metric — which measures the difference between the interest banks get from borrowers and what they pay savers — is tipped to soar to $7.77trn by the end of the period.

HSBC has considerable financial strength it can use to capitalise on this opportunity, too. Its CET1 capital ratio improved to 15.2% as of March.

Risk vs reward

Doubling-down on Asia doesn’t come without risk, however. Emerging markets tend to exhibit greater political and economic volatility compared to developed markets.

China’s economy is certainly suffering a prolonged slowdown. A steady cooling in the country’s property market is especially worrying. Data today (17 June) showed average home values plunging at their fastest rate for a decade in May.

But the risks this poses to HSBC’s profits forecasts seem baked into its rock-bottom share price, in my opinion.

Great value

Today the banking giant trades on a forward price-to-earnings (P/E) ratio of 6.9 times. Furthermore, its price-to-earnings growth (PEG) ratio comes in at 0.8.

A reminder that any reading below 1 indicates that a share is undervalued.

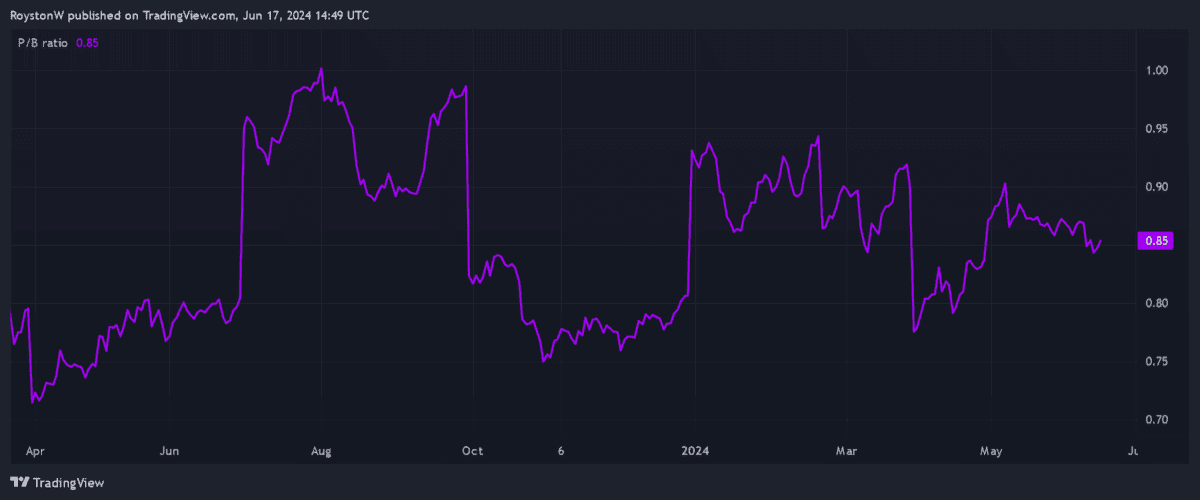

HSBC shares also look cheap when we consider the bank’s book value (total assets minus total liabilities). As the graph shows, its price-to-book (P/B) ratio stands at around 0.9, also below the value threshold of 1.

Finally, the dividend yield on the bank’s shares comes in at 9.1%. This makes it one of the biggest potential income payers on the FTSE 100 for this year.

HSBC shares aren’t without risk. But I believe that the Footsie bank has what it takes to deliver stunning investor returns over the long haul and is worth considering.