A recent Cambridge report confirms that the United States now leads global Bitcoin mining, prompting questions about how China will respond. Though the country has long held an anti-crypto stance, Chinese mining pools have historically controlled a substantial portion of the global Bitcoin hashrate.

The US’s current competitive edge and renewed hostility over trade policy might motivate China to recapitulate. BeInCrypto spoke with representatives from The Coin Bureau and Wanchain to understand what might encourage China to change its stance toward digital assets.

US Overtakes China as Top Bitcoin Mining Hub

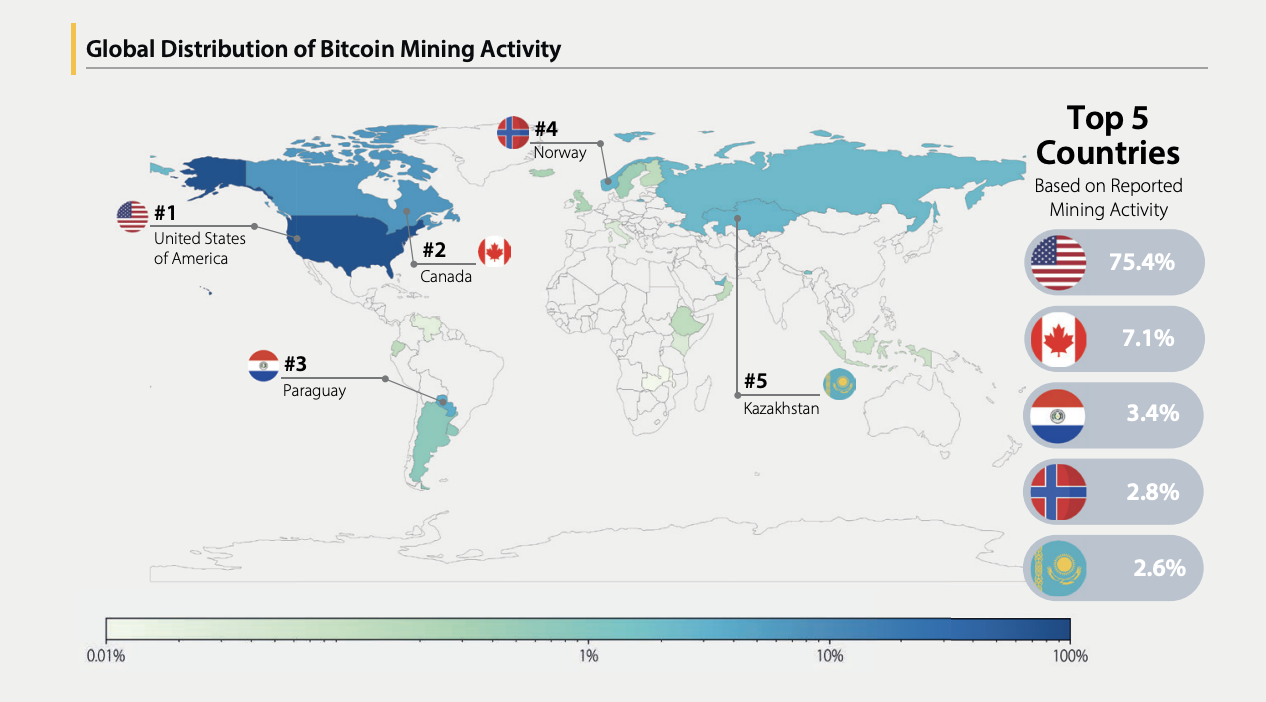

The US has firmly established itself as the world’s largest Bitcoin mining hub. A recent Cambridge Centre for Alternative Finance (CCAF) report revealed that the US accounts for 75.4% of the reported hashrate.

Global distribution of Bitcoin mining activity. Source: CCAF.

This newest development confirms a notable reversal of power over Bitcoin mining dominance. China emerged as the world’s leading Bitcoin mining nation as early as 2017, leveraging its extensive mining infrastructure and low electricity costs to contribute upwards of 75% of the global hash rate at one point.

Yet, the country would later crack down on the industry.

China’s Crypto Crackdown

In 2019, the National Development and Reform Commission of China (NDRC) signaled its intention to prohibit cryptocurrency mining by releasing a draft law categorizing it as an “undesirable industry.”

Two years later, at least four Chinese provinces began shutting down mining operations. These crackdowns intensified amid concerns over excessive energy consumption.

Toward the end of 2021, the government declared all crypto-related transactions illegal, further solidifying the ban and prohibiting overseas exchanges from serving Chinese citizens.

However, China possesses a proven capacity to adjust to geopolitical shifts that could jeopardize its economic dominance, and the current environment may present such a challenge.

Has Bitcoin Mining in China Truly Stopped?

Even with China’s official stance toward crypto, mining activity has not stopped within the region. In July 2024, Bitcoin environmental impact analyst Daniel Batten reported that the hashrate within China currently accounts for approximately 15% of the global total.

“Despite the official ban, the infrastructure is already in place: from offshore mining to cross-border trading hubs. With more global momentum behind crypto adoption and the US taking the lead, China may find itself incentivized to lean in more strategically, even if unofficially,” Nic Puckrin, Co-founder of the Coin Bureau, told BeInCrypto.

China also has a geographical advantage over the United States, especially regarding technological advancements.

Crypto mining, especially for proof-of-work cryptocurrencies like Bitcoin, depends on Application-Specific Integrated Circuit (ASIC) equipment to handle the necessary complex calculations for validation and mining.

China’s position as a top exporter of crypto mining hardware, particularly to the US, gives it a potential advantage should it decide to revive its mining sector.

The unfolding tariff dispute between the two nations adds a layer of uncertainty to the long-term cost efficiency of US mining operations.

Puckrin believes that the combination of trade friction and the US’s invigorated push for crypto dominance might be sufficient to make China reconsider its position.

“It’s unlikely China will make a public U-turn on its crypto mining and trading ban anytime soon. However, with US-based miners accounting for higher and higher proportions of Bitcoin’s hashrate, China is bound to be paying attention and may well be quietly reassessing its stance,” Puckrin told BeInCrypto.

However, China has strategies beyond restarting its Bitcoin mining industry to undermine the United States’ dominance.

China’s Nuanced Approach Beyond US Influence

Even though China opposes the widespread use of cryptocurrencies domestically, it may still see value in digital assets to counterbalance the US dollar’s global currency dominance.

Several countries worldwide have either adopted or are considering central bank digital currencies (CBDCs) to strengthen their domestic currencies. China is at the forefront of these developments.

“Despite the ban on Bitcoin mining, China has actively participated in the digital asset space, through initiatives like CDBC research and the digital yuan, or e-CNY,” Wanchain CEO Temujin Louie told BeInCrypto.

In fact, China’s efforts to create a digital yuan are partly driven by its desire to de-dollarize its economy and lessen its dependence on the US dollar.

Louie also suggested that whatever move China makes, it won’t solely base its decision on what the US does or does not do.

“As always, with China, a nuanced approach is best. Any shifts in policy will not be due to US tariffs. Rather, China’s decisions will be informed by global market trends and China’s own domestic strategy,” Louie added.

That said, China’s decisions about digital currency will, in turn, affect how its position on crypto continues to develop.

“Weakening USD dominance, whether exacerbated or caused by President Trump’s approach to tariffs, may embolden China to be more aggressive in [its] efforts to internationalise the yuan, including the digital yuan, or e-CNY. Any change to China’s broader strategy will be reflected in [its] stance towards crypto,” he concluded.

China’s activity in other areas of international trade already proves how nuanced its policy changes tend to be.

Could China’s Conflicting Crypto Policies Signal a Change?

Aside from its appreciation of digital currencies like the e-CNY, China’s stance on crypto has already proven somewhat contradictory. These discrepancies may fuel the belief that the country might just be willing to revert—or at least soften—its total ban on mining.

A month ago, investment firm VanEck confirmed that China and Russia –two countries particularly burdened by US sanctions– are reportedly settling some of their energy trades using Bitcoin.

“With the US dollar increasingly being used as a political lever –particularly in tariffed economies– other nations are actively exploring alternatives. Indeed, many countries around the world, including China and Russia, are already using Bitcoin as an alternative for trading in commodities and energy, for example. This trend is only going to accelerate as digital assets become a more prominent part of the global economy,” Puckrin told BeInCrypto.

According to Puckrin’s analysis of these indicators, China’s “shadow crypto economy” is projected to expand this year, which could result in a reassertion of its power. This resurgence would be primarily in response to de-dollarization efforts, rather than a reaction to US dominance in mining.

We’ll likely see this activity ramping up in the near future, especially as more countries use crypto to bypass dollar-dominated systems,” he concluded.

It will remain crucial to interpret China’s intentions, especially regarding cryptocurrency, by observing its actions rather than relying solely on its official statements.